how much tax on death

The named beneficiary of the RRIF will receive the amount paid out of the RRIF tax free if the amount is included in the deceased annuitants income. The amount you pay varies depending on a variety of factors including your income and size of gain.

Democrats Bring Back Death Tax Small Businesses And Family Farms Crushed

The DSUE is locked in by filing your spouses estate tax return which is due nine months from your spouses date of death.

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

. On the low end of the scale the rates are 18 for taxable amounts less than 10000. The amount of the monthly payment not subject to federal taxes varies depending upon the amount of the deceaseds previously taxed IMRF member contributions and the age of the. Tax Rate on an Inherited Annuity.

Income Tax Return for Estates and Trusts. What about Illinois Estate Tax. So the tax rate on an inherited annuity is your regular income tax.

How Much is the Death Tax. Thats 40 cents of every dollar you transfer. The gift tax exclusion for 2022 is 16000 per recipient per year.

The estate can pay Inheritance. All the people who lie in the 2020-21 tax year have a tax allowance of 325000 the nil rate band and the tax-free inheritance. All the assets of a deceased person that are worth 1170 million or more as of 2021 are subject to federal estate taxes.

The Inheritance Tax charged will be 40 of 175000 500000 minus 325000. If your spouse died in 2020 with the current. In the first year the tax cuts will cost Missouri 513 million in revenue and then once it is fully implemented it will cost the state 115 billion each year.

11 That means if you had the money you could whip out your checkbook and write 16000 tax-free checks to. The death benefit from a life insurance policy can help your family pay for your final expensesthings like transportation embalming a. The death tax can be any tax thats imposed on the transfer of property after someones death whether that tax is based on the total value of the decedents estate or the.

Youll also need that form if the estates gross. For amounts over 1 million. 2 days agoFinancial Benefits of Life Insurance.

The Estate and Gift Tax rates are found under 26 US. After you calculate the taxable portion of the estate the applicable tax rates ranging from 18 to 40 are applied to the estate tax bracket the amount falls into. A capital gain tax is levied on gains on residential property if the sale.

Every taxpayer has a lifetime estate tax exemption. The Internal Revenue Service IRS imposes an estate tax on the value of all of an estates assets at the time of death. That amount increases to 1206 million for the 2022.

Additional RRSP contributions. Its the same ever since 2010. If the deceased person is leaving a taxable estate you must file Form 1041.

Estates valued under 4 million do not need to file estate taxes. Inherited annuities are considered to be taxable income for the beneficiary. Code Section 2001 also.

Estate taxes should be paid within nine months after the death of the loved one. The higher the value of the estate the higher the tax rate you will pay. Under no circumstances can a deceased annuitants legal representative make a final contribution to the deceaseds RRSP after death.

Your estate is worth 500000 and your tax-free threshold is 325000.

What Is Inheritance Tax And How Much Is It

Top Ten Reasons The U S House Will Kill The Death Tax

Focus Shifts To State Estate Tax Planning Wsj

How Much Of Warren Buffett S Wealth Would The Insane Death Tax Drain

Estate Tax In The United States Wikipedia

Inheritance Tax Here S Who Pays And In Which States Bankrate

Avoiding Taxes On Life And Disability Insurance Wsj

New York Estate Planning Elder Law Death Tax

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

If I Die In Ca In 2014 How Much Can I Own Without Paying Death Taxes Law Office Of James F Roberts Associates Apc

What Is The Federal Estate Tax Sunshine Financial Solutions Insurance Retirement College Funding And Business Solutions

Help Us Repeal The Prop 19 Death Tax By Jon Coupal Aoausa

Death Taxes And A French Manicure A Tara Holloway Novel Kindle Edition By Kelly Diane Mystery Thriller Suspense Kindle Ebooks Amazon Com

How Does A Death In The Family Affect My Taxes

What Is The Death Tax And How Does It Work Smartasset

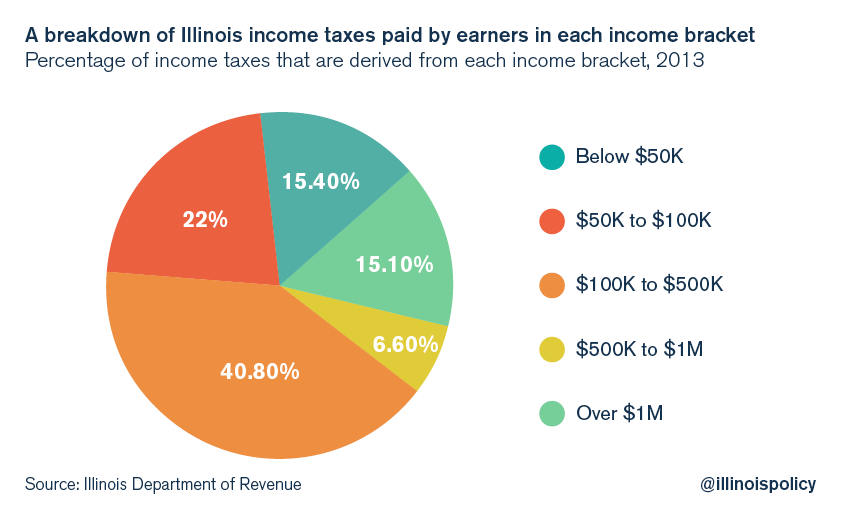

Federal Tax Changes Could Pressure Illinois To Repeal Death Tax

Invest Well Live Well How Much Tax Do I Pay When I Die Part One Of Two Kamloops This Week